Moniepoint log in is crucial for users as it serves as the central hub for managing their financial activities, such as,

Moniepoint log in is crucial for users as it serves as the central hub for managing their financial activities, such as,- Personal banking accounts,

- Debit cards,

- Loans, and

- Payment processing solutions.

However, this can be a bit tricky if you are a new user.

In this article, we'll guide you step-by-step through accessing and making the most of your dashboard so you can manage your finances with ease and confidence. Let's ge

Requirements for Creating a Moniepoint Account

Before Moniepoint log in, you must create a Moniepoint account. You will need the following to open the account:

Personal Information

- Phone number.

- Email address.

- National Identification Number (NIN) or Bank Verification Number (BVN).

- Valid government-issued ID (e.g., International Passport, Driver's License, Permanent Voter's Card).

- Utility bill for address verification.

Verification Process

- Download Moniepoint app on your device or visit atm.moniepoint.com on your browser.

- Enter your phone number and input the one-time password (OTP) sent to your phone for verification.

- Set up your passcode and transaction pin.

- Complete the face verification process to confirm you are the actual person opening the account and that your picture matches your NIN database.

Supported Devices

- Moniepoint Personal Banking app is available on iOS and Android devices.

- You can also access your account through the web portal at atm.moniepoint.com.

Downloading the Moniepoint App

Downloading the Moniepoint app is straightforward. Below is a step-by-step guide for downloading the app on different platforms and accessing it via the web browser.

For iOS Users

- Open the App Store on your iOS device.

- Search for "Moniepoint" in the search bar.

- Select the Moniepoint app from the search results.

- Tap the “Get” button to initiate the download.

- If prompted, enter your Apple ID and password to confirm the installation.

- Once the installation is complete, tap “Open” to launch the app.

For Android Users

- Open the Google Play Store on your Android device.

- Type "Moniepoint" in the search bar and hit search.

- Select the Moniepoint app from the search results.

- Tap the “Install” button to start the download.

- After the installation finishes, tap “Open” to access the app.

Alternative Access via a Web Browser

If you prefer not to download the app or are using a device that does not support it, you can access Moniepoint services through a web browser. Simply follow these steps:

- Open your preferred web browser.

- Navigate to atm.moniepoint.com.

- Log in using your registered phone number and password to access your personal banking dashboard.

Creating Your Moniepoint Account

Creating a Moniepoint account is simple and secure. It allows you to access a wide range of banking services. Follow the detailed instructions below to set up your account successfully.

Step 1: Go to the Sign-Up Page

- Open the Moniepoint App and tap on the Moniepoint icon on your device to launch it. Alternatively, you can visit atm.moniepoint.com on your web browser.

- On the app's home screen or the web portal, look for the “Sign Up” or “Create Account” option and tap or click on it.

Step 2: Enter your Personal Details

Input the below details on the registration page:

- An active phone number.

- Email address.

- National Identification Number (NIN) or Bank Verification Number (BVN).

- Finally, upload a government-issued identification document (e.g., International Passport, Driver's License, or Permanent Voter's Card) for verification purposes.

Step 3: Set Up a Secure Password

- Choose a strong password that is at least eight characters long and includes a mix of uppercase letters, lowercase letters, numbers, and special characters.

- Re-enter the password to ensure it matches the original entry.

Step 4: Confirm the Account Creation

- Before finalizing your account creation, review all entered details for accuracy.

- Read through the terms and conditions of Moniepoint and check the box to agree.

- Tap or click on the “Create Account” or “Sign Up” button to submit your application.

- You will receive an SMS or email containing a one-time password (OTP). Enter this OTP in the app or web portal to verify your account.

- Once verified, you will receive a confirmation message indicating that your Moniepoint account has been successfully created.

Moniepoint Log in

Moniepoint dashboard allows you to manage your finances conveniently. Follow these steps for Moniepoint log in:

- Open the Moniepoint App or visit atm.moniepoint.com on your web browser.

- Tap or click on the "Login" button.

- Enter your registered phone number and password.

- If prompted, enter the one-time password (OTP) sent to your phone for additional verification.

- Click "Submit" to log in to your personal banking dashboard.

If you encounter any Moniepoint log in issues, such as a forgotten password, follow these troubleshooting steps:

- Tap or click on the "Forgot Password" link on the Moniepoint log in page.

- Enter your registered phone number and click "Submit."

- Check your phone for an SMS containing a reset password link.

- Click on the link and follow the instructions to set a new password.

- Use the new password to log in to your Moniepoint account.

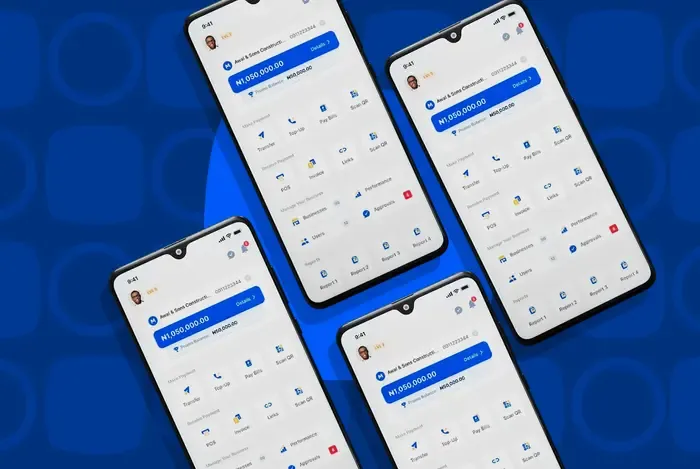

Navigating the Moniepoint Personal Banking Dashboard

After Moniepoint log in, you can access the dashboard. Here’s a brief overview of the key features and functionalities available on the Moniepoint dashboard:

Overview of Dashboard Features

- Account Summary: Here, you can view your current account balance, recent transactions, and personal account details, including your account number and KYC status.

- Transaction History: You can access a detailed list of all your transactions, allowing you to track your spending and manage your finances effectively.

- Bank Transfer Feature: Quickly transfer funds to other bank accounts or Moniepoint users with ease.

- Airtime and Bill Payments: Use the dashboard to top up your mobile airtime or pay various bills, such as utilities and subscriptions.

- Notifications: Stay updated with alerts regarding your account activities, including successful transactions and important reminders.

- Profile Management: Update your personal information, including your email, phone number, and security settings.

- Password and Security Options: Change your password and set up additional security measures to protect your account.

- View Transactions: Easily navigate to your transaction history to see all past activities, which can be filtered by date or type.

- Additional Services: Access features such as QR code payments, card management, and customer support directly from the dashboard.

Security Tips for Moniepoint Log in

Maintaining the security of your Moniepoint account is crucial to protect your financial information and prevent unauthorized access.

Here are some best practices to keep your account secure:

- Use a strong and unique password for Moniepoint log in.

- Enable two-factor authentication for an additional layer of security.

- Be cautious when accessing your account on public Wi-Fi networks.

- Regularly check your account activity and report any suspicious transactions immediately.

- Keep your contact information up to date to ensure you receive important security notifications.

- Be wary of unsolicited emails or messages requesting sensitive information.

- Never share your Moniepoint log in credentials or one-time passwords (OTPs) with anyone.

- Verify the authenticity of any website before entering your Moniepoint log in details.

- Use the official Moniepoint app or website for Moniepoint log in.

- Report any suspected phishing attempts or security breaches to Moniepoint's customer support immediately.

Final Words

Logging into your Moniepoint dashboard is essential for effective financial management. It provides you with access to a range of features that streamline your banking experience, from tracking transactions to making payments.

We encourage you to explore the various services offered, such as bill payments, fund transfers, and account management tools. By taking full advantage of these features, you can enhance your financial control and make informed decisions.

Embrace the convenience of Moniepoint and empower yourself to achieve your financial goals with confidence.

Additional Resources

For assistance with Moniepoint services, you can access various support resources:

Moniepoint Support and FAQs

- Visit the Moniepoint Help Center for frequently asked questions and troubleshooting tips: Moniepoint Help Center.

- You can access customer support directly through the app by tapping on Help or Support, then selecting Contact Us or Report an Issue.

Customer Service Assistance

- Customer Care Email: [email protected]

- Customer Care Phone Number: 01 888 9990

- WhatsApp Support: +234 908 843 0803

If you have any issues, including fraud or account restrictions, you can submit a request through the Moniepoint website or contact their customer service for immediate assistance.

FAQs

1. What do I need to create a Moniepoint personal banking account?

To create a Moniepoint personal banking account, you'll need your email address and phone number. You must verify your identity through SMS or email and provide your Bank Verification Number (BVN) and a valid ID for KYC verification.

2. How do I download the Moniepoint app?

You can download the Moniepoint app from the Apple App Store for iOS devices or Google Play Store for Android devices.

3. How do I log in to the Moniepoint personal banking dashboard?

To log in, open the Moniepoint app or visit the website's login page. Enter your registered phone number and password, then click "Login." If you’ve forgotten your password, use the "Forgot Password" option to reset it.

4. What should I do if I can't log in to my Moniepoint account?

If you encounter login issues, check your internet connection and ensure that you’ve entered the correct login details. If your account is locked due to multiple incorrect login attempts, reset your password or contact customer support for assistance.

5. What security measures should I follow when using Moniepoint?

Moniepoint uses advanced security features like two-factor authentication (2FA) and biometric login options. Always keep your login credentials secure and avoid sharing them. Be cautious of phishing attempts and report any suspicious activity.

6. How do I access my transaction history on the Moniepoint dashboard?

To view your transaction history, log in to your Moniepoint account, navigate to the "Payments" section, and select the transactions you want to review. You can view both recent and older transactions.

7. What can I do from my Moniepoint dashboard?

You can transfer funds, pay bills, top-up airtime, and manage your savings plans on a Moniepoint dashboard. You can also order a debit card, view your account balance, and monitor your transaction history.

8. What are the steps to withdraw savings from Moniepoint?

To withdraw from your savings, log in to your Moniepoint dashboard, navigate to your savings plan, and click "Withdraw." Enter the amount you wish to withdraw and confirm the transaction.