In 2016, Vodacom announced the closure of M-Pesa in South Africa. This move came as a surprise to everyone because the mobile money service succeeded in many African countries including Kenya, Egypt, Ghana, Tanzania, Lesotho, DR Congo, Mozambique and others.

M-pesa was launched in South Africa in 2010, three years after it's established in Kenya. However, six years later, the parent company in the country, Vodacom, announced its closure. Why?

In this article, I will tell you the history of M-Pesa in South Africa and why the East Africa largest mobile money operator failed in South Africa.

M-Pesa is the leading mobile banking operator in East Africa. The service allows users to save, send and receive money locally and internationally through IMT partners such as PayPal.

The M-Pesa services was established, owned and currently being managed by Safaricom, the leading telecommunication company in Kenya. M-pesa was launched in Kenya in 2007, and since then, it's been offering standard financially solutions across the African continent.

Is M-Pesa available in South Africa?

No, M-Pesa is currently not available in South Africa. The mobile money service was shut down in 2016 by it parent company (Vodacom) in the country.

Currently, VodaPay, a new born financial service of Vodacom, is roaming the financial market of the country. Continue reading to see what it offers.

Why M-Pesa shutdown operations in South Africa?

M-Pesa was launched in South Africa in the time Football World Cup was hosted in the country. Perhaps, Vodacom think its could use that as an opportunity to dive into the market and pack shares. But no, things want South.

In addition, Vodacom owned the largest telecom user base in South Africa, perhaps, it thought it could build an M-Pesa customer base of 10 million in three years with that influence.

However, M-pesa accounted for only 76,000 active customers in the country in six years, sighting a significant disappointment to the company.

Why M-Pesa Failed in South Africa

South Africa boasts a well-developed and relatively stable banking system, resembling the UK model more than the US. This has been cited as one of the reasons M-pesa failed in the country.

During the time of incepting M-pesa in South Africa, Vodacom partnered with Nedbank, hoping that it could revolutionizing the commercial bank's middle-class and high-income earners. But it's unfortunate that the bank customers already have an array of banking services and platforms through which they conduct their businesses.

Besides, South Africa is a country where banking is made simple. Report said "around 16% of adults remain unbanked, with efforts ongoing to increase access." More so, South African banks are growing at an annual rate of 7%.

On South African roads (in both urban and rural settlement), you can account for at least bank branches, mobile money agents or ATMs within every 20km (12-mile) radius.

In addition, M-pesa also saw the highlighted below as a challenges it faced during its operations in South Africa:

- Central Bank: The South African Reserve Bank (SARB) sets monetary policy, regulates banks, and ensures financial stability.

- Private Sector Banks: These dominate the market, with five major players – Standard Bank, FirstRand, Absa, Nedbank, and Investec – holding around 90% of assets.

- Mutual Banks: These are member-owned and focus on specific communities or sectors.

- New Players: Capitec Bank has gained traction in recent years, catering to the unbanked and underbanked segments.

However, financial challenges in South Africa is not about "Access," rather, it's about technology adoption. South Africans needs improvement in how the save, spend and invest their money.

Hence, M-pesa should had focus on; enhancing savings schemes and pension funds, giving customers access to link their bank account to pay for hospital bills, retailers, insurance, municipalities and access to revenue services, because this is what South Africans needs and banks and mobile mobile operators in the country are focusing on.

Currently, online and mobile banking in South Africa are growing rapidly, fueled by a young, tech-savvy population. On the other hand, Mobile phone operators are working towards opening more secure platforms, all for the sake of leveraging technologies to enhance how people save, spend and invest their money in South Africa.

In essence, all mentioned above had participated in M-pesa's failures in South Africa. Although, the Vodacom retry. Let's see how it goes in the next section.

Vodacom's Retries in South Africa

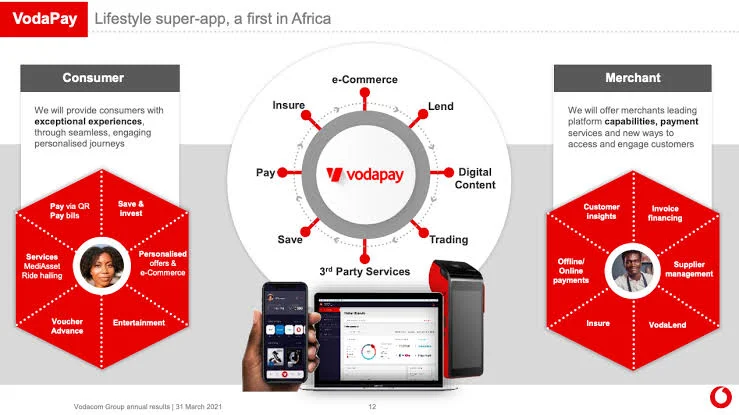

In July 2020, Vodacom announced "Super App" that will caters for South Africans' finances and lifestyle. This news came after four years its M-pesa failed in the country.

The company partnered with Ant Financial Services (the China-based payments company, formerly known by the name of its signature product, Alipay), aimed to create a comprehensive platform offering; financial services (such as payments, bill payments, money transfers), lifestyle services (such as shopping, entertainment), and digital shopping experiences

In essence, Vodacom also leveraged its large customer base and Ant Financial's expertise to gain a foothold in the competitive market.

In October 2021, Vodacom officially launched VodaPay super app to customers on any mobile network, replacing the My Vodacom App, otherwise known as the "Super App."

The Vodapay Super App offers features like: cashless payments, in-app rewards, P2P money transfers (currently limited to Vodacom users), bill payments, and online shopping integration.

Vodacom remains committed to expanding VodaPay's functionality and user base which was undeterred by the M-Pesa failure. The company emphasized its differentiation from M-Pesa, focusing on a broader service suite and integration with the Vodacom ecosystem.

Although, VodaPay is in its early stages, and its impact on the South African financial landscape remains to be seen. In addition, the app initial user adoption data is not yet available. It's also noteworthy that Vodacom is still facing competition from established players, other super apps, and fintech startups in the country.

Final words: Recap of M-Pesa History in South Africa

Vodacom launched M-Pesa in South Africa in 2010, aiming to replicate its success in Kenya. But unfortunately, the payment service struggled to gain traction, due to factors like: established players like the major players – Standard Bank, FirstRand, Absa, Nedbank, and Investec and the FNB and MTN Mobile Money that held strong market positions.

Another things that participated in M-pesa's failures in South Africa includes: complex regulatory hurdles that hampered innovation and user adoption, and lack of unique value proposition (that's, M-Pesa offered similar features to existing options).

After six years with only 76,000 active users, Vodacom shut down M-Pesa in South Africa in 2016, shifting strategies to "super app" in July 2020 and VodaPay in October 2021.

However, Vodacom continues to offer M-Pesa services in other African markets where it has proven successful. The success of VodaPay will depend on its ability to offer unique value, attract users, and navigate a competitive environment.

I hope this comprehensive overview helps you understand Vodacom's evolving financial services strategy in South Africa. If you have any further questions about specific aspects, feel free to ask in the comments section.